All Categories

Featured

Table of Contents

- – Comprehensive Real Estate Accredited Investors...

- – Reliable Real Estate Crowdfunding Accredited I...

- – Secure Tax-advantaged Investments For Accredi...

- – Experienced Commercial Real Estate For Accred...

- – Dependable Accredited Investor Income Opport...

- – Dynamic Investments For Accredited Investors

The enroller finds financial investment chances and has a group in place to take care of every obligation for the building. Property distributes pool money from accredited capitalists to buy properties lined up with well established objectives. Personal equity genuine estate lets you buy a group of properties. Recognized capitalists merge their cash with each other to fund acquisitions and residential or commercial property advancement.

Realty investment trust funds have to disperse 90% of their taxable income to investors as rewards. You can deal REITs on the stock market, making them extra liquid than the majority of financial investments. REITs allow financiers to expand promptly throughout numerous residential or commercial property classes with very little funding. While REITs also turn you into an easy capitalist, you get even more control over crucial choices if you sign up with a genuine estate distribute.

Comprehensive Real Estate Accredited Investors ([:city] [:state])

The holder can make a decision to execute the exchangeable option or to market before the conversion happens. Convertible bonds enable investors to acquire bonds that can become stocks in the future. Capitalists will certainly benefit if the stock rate rises since exchangeable financial investments provide them more appealing entry factors. Nonetheless, if the supply topples, investors can decide versus the conversion and safeguard their funds.

Hedge fund supervisors usually provide a small window when investors can withdraw funds. If you miss the home window, you might be incapable to take money out of your setting for a quarter or longer. Hedge fund financiers additionally have to compete with higher administration fees which can get in the way of returns.

Interval funds do not trade on second markets and force you to end up being a long-lasting investor. Rather, capitalists have a small timeframe to deposit and withdraw funds before obtaining locked into an interval fund for a few months. These extra intricate funds expose capitalists to exclusive genuine estate, hedge funds, and other high-risk possessions.

Cryptocurrencies are speculative properties that have actually taken off over the previous decade. While Bitcoin is the most established electronic money, financiers can pick from thousands of altcoins. Altcoins are extra unstable than Bitcoin, but several of them have actually outshined Bitcoin. You can get and hold crypto and benefit from cost appreciation, but there is likewise one more way to earn money with crypto.

Reliable Real Estate Crowdfunding Accredited Investors Near Me ([:city] [:postcode] [:state])

Throughout crypto staking, you allowed other people obtain your crypto and receive passion, simply like a bank offering cash. People obtain cryptocurrencies to help confirm transactions and get greater benefits from the crypto blockchain. Actual estate investing offers even more options than crypto and other properties, and real estate always has inherent worth.

Today, we're speaking concerning all things being recognized capitalists. So by the end of this blog site, you must be a pro at the vital information bordering the safety and securities and exchange commissions, and classification of accredited capitalist status. For those of you that do not recognize me, my name is Nic DeAngelo with Saint Investment Group.

Secure Tax-advantaged Investments For Accredited Investors Near Me – [:city] [:postcode] [:state]

As much as many funds are worried, they're limited to legally only approving recognized financiers later on in the video clip. I'll enter and describe our individual experience and exactly how our procedure functions to provide you a real-life example. So allow's enter into defining exactly what an accredited financier is.

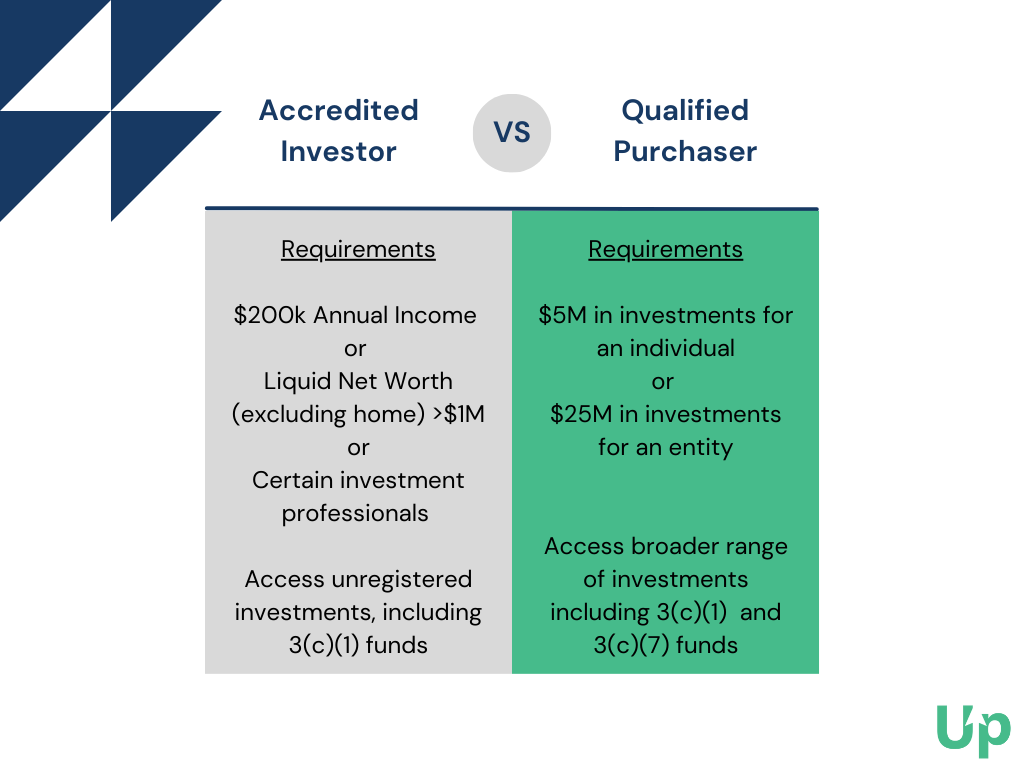

Let's start with the requirements for people since that's most likely why you're below to be an accredited capitalist. You must be one. Either of the complying with requirements, one standard is based on your income, and the various other requirements is based on your web well worth and again, you just require one to be thought about approved.

Experienced Commercial Real Estate For Accredited Investors Near Me

You should have a gained income of $200,000 each year or more for the last two years and the expectation that should proceed in the future. Additionally, if you're married, you can qualify - real estate accredited investors. If you have a $300,000 house income or higher that's an alternative one going the income course

You should have an internet well worth of $1 million or even more, however below's a large catch. That's omitting your key house due to the fact that, for many Americans, their key locals are just one of the greatest boosters to their internet well worth generally. For numerous Americans, their home is the biggest asset they will ever get in their lifetime.

I'm gon na give you an outstanding means to bear in mind the SEC's certified capitalist interpretation. We'll call this the 1,2,3. 1= equals a $1 million total assets or greater omitting your key residence. 2= $200,000 earned revenue or higher as a person. 3= $300,000 or more as a couple. To make sure that's the 1, 2, and 3 of recognized financier condition.

Dependable Accredited Investor Income Opportunities Near Me ([:city] [:state])

However We see this generally with high internet well worth and extremely financially innovative people that wan na make use of various entities, either for tax obligation factors or for property protection or a few other factor, due to the fact that there's very advanced and they have an entire team of people that create these approaches. Yet dive into the meaning of what the SEC considers an accredited investor entity.

This is great. This is a time when the federal government actioned in and efficiently made regulations to safeguard investors who are getting shed in the wake of massive economic disruption. The SEC takes place to mention its objectives with these regulations stating that these regulations are to guarantee that all getting involved capitalists are economically advanced and able to take care of themselves or sustain the danger of loss, hence rendering, unneeded, the defenses that come from a registered offering.

Yet essentially the key takeaways right here are that the SEC believes that individuals that have higher revenue and greater internet worth are most likely to be monetarily innovative and they're additionally more probable to stand up to a complete monetary loss. If that investment did not exercise, whether or not these assumptions hold true is a case-by-case situation.

Table of Contents

- – Comprehensive Real Estate Accredited Investors...

- – Reliable Real Estate Crowdfunding Accredited I...

- – Secure Tax-advantaged Investments For Accredi...

- – Experienced Commercial Real Estate For Accred...

- – Dependable Accredited Investor Income Opport...

- – Dynamic Investments For Accredited Investors

Latest Posts

Tax Delinquent Homes For Sale

List Of Tax Properties For Sale

Investing In Tax Lien Certificates

More

Latest Posts

Tax Delinquent Homes For Sale

List Of Tax Properties For Sale

Investing In Tax Lien Certificates